Summary

The purpose of this document is to provide guidance on reclaiming the VAT from your

lottery, freeing up money that can be used to marketing your lottery and help it grow.

Gatherwell is a VAT registered company (GB195014806) and is required to charge

standard rated VAT for its services. Please reference section 5 in the HMRC advice notice

https://www.gov.uk/guidance/how-vat-applies-to-betting-gaming-and-lotteries-notice-70129

A service charge on all Gatherwell lotteries is factored into the ticket price. Currently, all

Community Lotteries run by Gatherwell have a 16.67p service charge, therefore the £1

ticket includes 3.33p of VAT (this is the standard 20% VAT rate on the 16.67p). The

remaining 80p from each ticket (for prizes and good causes) is not subject to VAT.

As stated in the same HMRC notice, https://www.gov.uk/guidance/how-vat-applies-tobetting-gaming-and-lotteries-notice-70129 VAT is recoverable by the Local Authority. Gatherwell facilitates this recovery of VAT with the provision of VAT invoices.

How to account for the VAT?

Different authorities have chosen to account for VAT in different ways. Whichever method is

used, we provide the information you need to recover the VAT.

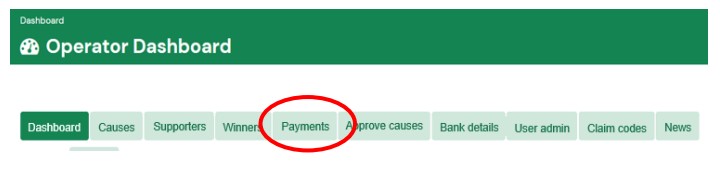

1. Go to ‘Payments’ tab on the lottery dashboard (you’ll need to have the correct

permissions for this to be visible)

2. On the right hand side, under ‘Actions’ click on the ‘Review’ link for the payment

period you wish to reclaim.

3. Click the ‘Download Operator Invoice’ PDF – you will need the figures from this

invoice to reclaim the VAT amount.

Option 1 – simple recovery for VAT only

Debit your VAT account (input tax) with the value of the VAT shown in the right hand

column on the invoice, this enables you to include and recover it on your VAT return. You

can then credit your Lottery cost code.

Option 2 – recovery for VAT & grossing up for prizes

Some authorities have chosen, for transparency, to account for the prizes element of the £1

in their internal systems.

The following stages are required on your systems:

1. Credit the ticket sales code (e.g 40% of ticket sales*)

2. Debit the VAT input tax account (VAT Amount)

3. Debit the Management fee cost code (Service Charge Amount)

4. Debit the Prizes cost code (e.g 20% of total revenue*)

5. The total invoice then needs netting down to a nil payment, as all payments due are

already recovered direct by Gatherwell.

These stages not only recover the VAT but also makes sure all costs and income are

accounted for correctly. - NB The reporting of money paid to good causes is captured

separately on the Lottery website so isn’t included on internal systems

Option 3 – recovery for VAT & grossing up for prizes & good causes

Some authorities have chosen for transparency to account for both the prizes and good

cause element of the £1 in their internal systems. The following stages are then required on

your systems:

1. Credit the ticket sales code (100% of ticket sales)

2. Debit the VAT input tax account (VAT Amount)

3. Debit the Management fee cost code (Service Charge Amount)

4. Debit the Prizes cost code (e.g 20% of total revenue)

5. Debit the Good Cause cost code (e.g 60% of total revenue)

6. The total invoice then needs netting down to a nil payment, as all payments due are

already recovered direct by Gatherwell.

These stages not only recover the VAT but also makes sure all costs and income are

accounted for entirely on the internal systems.

*These values are dependent on the model adopted